Hi, I’m Frank Chandler with Fairway Mortgage.

Following decades of experience as a licensed Financial Planner, I help people 62 and older understand a financial tool that can be a gamechanger for retirement—Reverse Mortgage Loans.

What are the top three things a Reverse Mortgage Loan can do for you?

Eliminate Your Monthly Mortgage Payment

Borrower must still pay taxes, insurance, and maintain the home.

Turn Home Equity Into Tax Free Money*

Provide the Opportunity for Tax Benefits*

It’s True

Reverse Mortgages are no longer only a loan of last resort. They are quickly becoming a Retirement Planning Game Changer for a lot of homeowners age 62 plus.

Homeowners retain full ownership of their homes

Spouses under 62 who are too young to qualify have the option to stay in the home if the borrowing spouse passes away

This is a non-recourse loan—you can never owe more than the value of the home**

Discover Frank Chandler: Your Trusted Reverse Mortgage Educator

With an extensive background spanning nearly three decades as a Licensed Financial Planner and Wholesale Professional at prestigious institutions such as Drexel Burnham Lambert, Bear Stearns, Smith Barney, and Boston Capital, I embarked on a remarkable journey of discovery – one that led me to the realm of Reverse Mortgages.

Throughout my professional odyssey, my intrigue for Reverse Mortgages grew exponentially. What once appeared only as a last-resort financial option transformed into an unequivocal game changer for retirement planning, particularly among homeowners aged 62 and above, in the group we often refer to as the ‘Mass Affluent’.

Since 2015, my unwavering focus has revolved around enlightening Financial Professionals about the transformative potential of Reverse Mortgages when used as a financial planning tool. My passion lies not in sales, but in empowerment through knowledge. This commitment, along with my ongoing monthly Educational Lunch Seminars for Financial Professionals, has earned me the title “the Reverse Mortgage Educator,” a moniker attributed by numerous Financial Planners who have benefited from my educational approach.

Join me in unraveling the possibilities that Reverse Mortgages offer for Senior Citizens. I am dedicated to demystifying the intricate workings of this financial tool, and I find immense joy in equipping individuals with the insights they need to make informed decisions about their retirement journey.

Discover Frank Chandler: Your Trusted Reverse Mortgage Educator

With an extensive background spanning nearly three decades as a Licensed Financial Planner and Wholesale Professional at prestigious institutions such as Drexel Burnham Lambert, Bear Stearns, Smith Barney, and Boston Capital, I embarked on a remarkable journey of discovery – one that led me to the realm of Reverse Mortgages.

Throughout my professional odyssey, my intrigue for Reverse Mortgages grew exponentially. What once appeared only as a last-resort financial option transformed into an unequivocal game changer for retirement planning, particularly among homeowners aged 62 and above, in the group we often refer to as the ‘Mass Affluent’.

Since 2015, my unwavering focus has revolved around enlightening Financial Planners about the transformative potential of Reverse Mortgages. My passion lies not in sales, but in empowerment through knowledge. This unwavering commitment has earned me the title “the Reverse Mortgage Educator,” a moniker attributed by numerous Financial Planners who have benefited from my educational approach.

Join me in unraveling the possibilities that Reverse Mortgages offer for Senior Citizens. I am dedicated to demystifying the intricate workings of this financial tool, and I find immense joy in equipping individuals with the insights they need to make informed decisions about their retirement journey.

Learn How Reverse Mortgages Can Change Lives

Whether you’re a homeowner, helping a retired parent, or a professional who works with seniors, a Reverse Mortgage Loan offers financial security in a variety of situations.

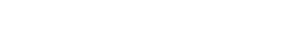

We Go Above and Beyond

When you work with Fairway Independent Mortgage Corp., you get more than the strength of a nationwide lender. Customer service is a way of life for us, and our values ensure that as a customer, you will always feel valued.

More than 6,500 employees

More than 600 locations nationwide

Top 10 biggest US mortgage lenders

Curious About What You May Qualify For?

An accurate reverse mortgage estimate requires a bit of personal information. Please fill out the following form and we will give you a call to talk through the numbers.

*This advertisement does not constitute tax and/or financial advice from Fairway

** There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.