There is and likely will always be a debate between what’s better, “optimistic” or “realistic” thinking. When it comes to retirement and aging, it’s beneficial to have both mindsets. To look forward to the enjoyment of the golden years while recognizing the need to plan ahead for rainy days.

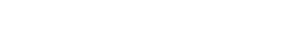

This is essentially the goal of financial planning for retirement. Helping clients establish the investments necessary to fund a realistic lifestyle they can enjoy, while providing as many safeguards as possible for potential market risks. But there is another risk to retirement finances that has nothing to do with the market and everything to do with health—long-term care. For insurance agents, protection for long-term care has everything to do with finances.

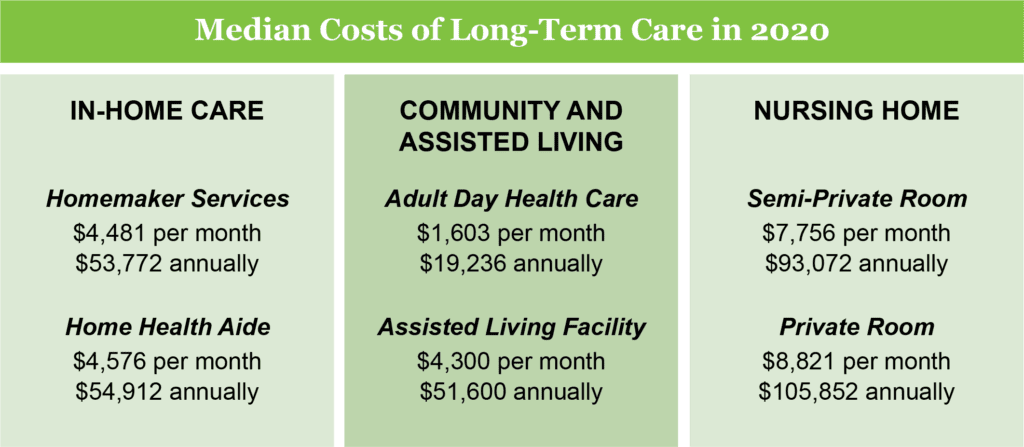

Long-term care can range from getting help with basic needs like grocery shopping to full-time care in an institutional setting. The high costs of a nursing home stay are fairly obvious, but it may be shocking to see that even less intensive forms of long-term care are still very expensive.

Whether you are a financial advisor or an insurance agent, the statistics show that long-term care and associated costs will affect the majority of your elderly clients. Those same statistics indicate that most of those clients will be financially unprepared. Logically, most retirees know people who have needed long-term care, and they understand that as they age, the probability of needing help is going to increase. So why aren’t more people planning ahead?

Why More People Aren’t Planning for Long-Term Care

This goes back to the issue of optimistic thinking. And it goes beyond the assumption that the worst only happens to other people. Most people actually believe they are prepared for long-term care expenses, and the most common rationales fall into three categories of misinformation.

1. People Who Believe Medicaid Will Take Care of the Expenses

It is true that Medicaid will pay for certain long-term care expenses, but only after very strict financial requirements are met. While these and other qualifications differ from state-to-state, generally speaking, Medicaid will only kick in after a person has exhausted their savings and assets on long-term care. Whether they realize it or not, this group of people have resigned themselves to something close to poverty in the event that they need intensive long-term care, because that is essentially a prerequisite for Medicaid funding.

2. People Who Underestimate the Expenses of Long-Term Care

This group of people may point to a paid-off house, robust retirement savings, a sizable IRA, and maybe even pensions. But it only takes five years in a nursing home to cost about $500,000, or ten years of homemaker services. Even a wealthy retired couple can go bankrupt living on a fixed income and paying those expenses out of pocket. Additionally, the costs of long-term care are only going up.

It is estimated that by 2040, the costs across in-home care, community and assisted living, and nursing homes will rise by a combined 53%.

3. People Who Believe That They Can’t Afford Long-Term Care Protection

Then there are people who would like to have some form of protection for long-term care expenses, but believe that they can’t afford it. Options like long-term care insurance, different types of life insurance, or annuities may in fact be out of reach for some people. But homeowners above the age of 62 may be eligible for a unique financial product that can fund these safeguards or at least provide a robust cushion of cash to pay for the unexpected.

A Guaranteed Line of Credit That Grows Over Time

When it comes to paying for protections against long-term care costs, or paying for it out of pocket, home equity is not much use without selling the property. Unfortunately, many seniors who are burdened with intensive long-term care costs are in fact forced to sell their homes, and then pay all the proceeds to care providers.

A reverse mortgage loan gives many homeowners over the age of 62 the ability to liquidate a portion of their home equity, which can then be applied to retirement planning and insurance purposes*. Any remaining mortgage balance will be paid off from their loan proceeds, there will be no obligation to make monthly mortgage payments, and they will own the house just like they did before. They will simply need to keep up with their property taxes, homeowners insurance, and maintain the home.

But one type of reverse mortgage payout model—the reverse mortgage line of credit—is especially useful for preparing for the unexpected. This line of credit is federally insured, can never be frozen, and the unused portion of the loan grows at a guaranteed rate over time. This is just an example, but if a couple was eligible for a $200,000 line of credit in their 60s, that line of credit could realistically grow to more than $800,000 by the time the homeowners are in their 80s*.

The Best Time to Get an Umbrella Is When It’s Not Raining

Modified term payment plans provide monthly payments for a fixed period (6 months, 12 months, 18 months, etc.), creating a reliable and regular source of cash. The term payments can be flexible depending on how much the borrower wants to access monthly and, once the term period concludes, changes to a flexible line of credit.

Let’s Start a Conversation!

If you’re interested in learning more, we can help with preparing for the unexpected and managing long-term care preparation.

* This advertisement does not constitute tax and/or financial advice from Fairway

** There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.

*** This information is provided as a guideline and does not reflect the final outcome for any particular homebuyer or property. The actual reverse mortgage available funds are based on current interest rates, current charges associated with loan, borrower date of birth (or non-borrowing spouse, if applicable), the property sales price and standard closing cost. Interest rates and loan fees are subject to change without notice. Following the closing of the home purchase, no further principal or interest payments will be required as long as one borrower occupies the home as their primary residence and adheres to all HUD guidelines of loan. Borrower must remain current on property taxes, homeowner’s insurance (and homeowner association dues, if applicable), and home must be maintained.