Home equity is a major source of wealth for most senior homeowners and there are many ways they can create liquidity from their built-up housing wealth to fund their retirement, such as Home Equity Lines of Credit (HELOCs), Home Equity Loans (HELs) or Home Equity Conversion Mortgages (HECMs), commonly known as reverse mortgage loans. However, each comes with its own benefits, drawbacks and costs.

For example, homeowners can borrow against the value of their home by taking out a traditional cash-out refinance mortgage or a second mortgage, such as a HELOC or HEL. These traditional products allow homeowners to access equity as cash and stay in the home, but may come with upfront costs, may be difficult for retirees to qualify for and will require monthly interest and/or principal payments, according to the loan terms, until the balance is repaid in full.

Of course, the homeowner can also sell the home to cash in on their housing wealth. However, that would require moving out of the home they know and love and find a new place to live.

For eligible older homeowners, there are also reverse mortgage loans to consider. With a reverse mortgage, a homeowner can borrow against the value of their home while continuing to live in and own it, with the flexibility to defer repayment until they’ve permanently left the home.

In this article, we’ll cover what a HECM reverse mortgage loan is, the typical upfront and ongoing costs and whether those costs are worth it for you.

What Is a Reverse Mortgage Loan?

A HECM (Home Equity Conversion Mortgage) is the only reverse mortgage insured by the Federal Housing Administration (FHA) and is the most popular reverse mortgage among homeowners.

To put it briefly, it allows homeowners 62 and older to access a percentage of their home equity as cash or a line of credit. The borrower can pay as much or as little toward the loan balance each month as they wish, with most HECM borrowers opting to make no monthly mortgage payments (though they must live in the home and pay property charges, like taxes and insurance).

Like any mortgage, the loan balance eventually must be repaid. However, a HECM balance does not typically become due and payable until the last surviving borrower permanently leaves the home (e.g., passes away or moves into a nursing home), regardless of how far into the future that may be.

The loan balance can also become due and payable if the borrower neglects their loan obligations, such as failing to pay the property taxes in a timely manner. When the loan is due and payable, it is typically satisfied via the sale of the home.

For a more in-depth look at the features of HECM reverse mortgages, we’ve covered in detail how a HECM works.

What Are the Costs of a HECM?

Lenders are required to provide prospective HECM borrowers with a Good Faith Estimate (GFE) of the loan costs. Almost all of the HECM loan costs can be rolled into the loan (meaning not paid out of pocket), and the vast majority of HECM borrowers go with that option, as they know they won’t be required to make monthly mortgage payments for the life of the loan. You just need to pay taxes, insurance, and maintain the home.

If you use your loan to pay the upfront costs, your initial allowable net loan proceeds will be reduced in direct correlation to the dollar amount of the costs you are financing.

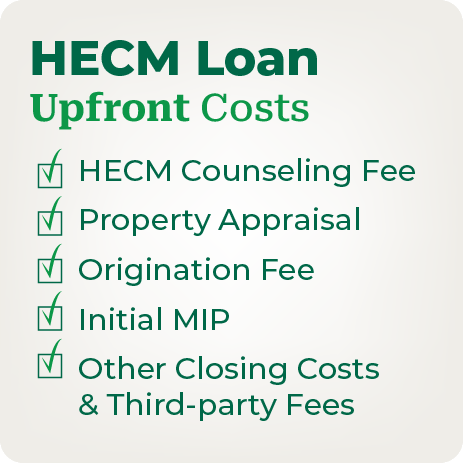

Upfront Costs

HECM Counseling Fee

The counseling fee is one the few costs the borrower must pay out of pocket and is usually directly paid to the counseling agency. The fee is typically around $150 but varies based on the fee structure of the agency.

The objectives of the session are to make sure you fully understand the loan program and to help you determine if it is a good fit. Counseling is conducted by U.S. Department of Housing and Urban Development (HUD)-approved independent third parties. The session is required, and it can be done in person or over the phone.

Property Appraisal

The property appraisal is another cost that the prospective borrower must pay out of pocket and is around $500, on average, but costs vary based on the fee structure of the appraisal management company.

The appraisal establishes the current value of your home. Your home value, the expected interest rate on the loan and the age of the youngest borrower (or non-borrowing spouse, if applicable) are the key components in determining the amount of loan proceeds you may qualify for.

Origination Fee

The origination fee can be rolled into your loan. You can expect to pay the greater of:

- $2,500, or

- 2% of the first $200,000 in home value, plus 1% of the home value that exceeds $200,000—but never more than the maximum allowable fee of $6,000.

The origination fee is what the lender charges for establishing the loan. It typically covers various administrative costs, such as processing and underwriting the loan.

Initial MIP

Initial Mortgage Insurance Premium (MIP) can be rolled into your loan. The cost is the lesser of:

- 2% of the home value, or

- 2% of the HECM limit (currently $1,089,300).

For example, if the home value is $423,000, then after calculating 2% of $423,000, your initial MIP cost would be $8,460.

Both initial MIP and annual MIP (which we’ll cover later) end up in the Mutual Mortgage Insurance Fund. The FHA uses this fund to pay out claims when the home sells for less than the loan balance. In other words, it guarantees that the borrower and their heirs are never stuck with a bill when the loan is due and payable. Even if home values decline well below the balance you owe on the loan, the sale of the home will always satisfy the loan. This protection, insured by the FHA, is what’s known as the loan’s non-recourse feature.

Note: If the home were to sell for more than loan balance, the borrower or their heirs can pocket the difference, just like they could with any other mortgage.

Other Closing Costs & Third-party Fees

Like other mortgage types, there are going to be third-party and other costs in order to get everything in place for your loan closing, such as a title search, surveys and recording fees. Typically, these costs and fees can be rolled into the loan.

The lender should provide these costs to you prior to closing and the costs should be itemized, with indications of what services you can shop for.

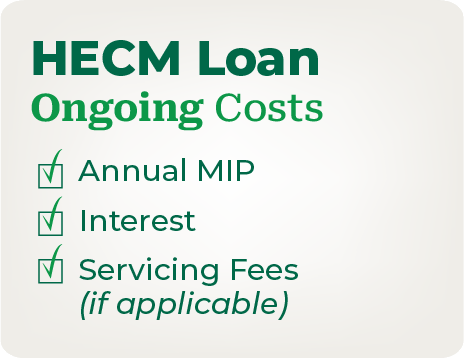

Ongoing Costs

Annual MIP

Annual Mortgage Insurance Premiums can be rolled into your loan. Over the life of the loan, you are charged annual MIP that is calculated at 0.5% of the outstanding mortgage balance.

Of course, the amount owed varies based on how much of the available loan proceeds you’re using and if you’re making voluntarily prepayments toward the loan balance. The most common way today’s borrowers access their loan funds is via a line of credit. Any pledged funds left unused in the line of credit do not accrue interest or MIP.

The MIP costs (both initial and ongoing) serve a specific purpose: to help the loan’s non-recourse feature, which guarantees that you and your heirs never owe more than the value of the home when the home is sold. It’s a premium benefit that comes at a cost.

Interest

Interest on the balance you carry can be rolled into your loan. An unpaid outstanding HECM loan balance accrues both interest and annual MIP, causing the unpaid balance to rise over time.

For example, if the HECM borrower establishes a standby line of credit, rolls $12,000 in closing costs into the loan and doesn’t draw any funds in the first year or make any voluntary prepayments, with an interest rate of 6.0% and MIP of 0.5% applied to the $12,000 balance, the balance will have risen to $12,780. In other words, the annual interest and MIP cost to the borrower in the first year is $780.

Servicing Fees (if applicable)

Lenders can charge monthly servicing fees, but those fees are limited to no more than $30 a month if the loan has an annually adjusting or fixed interest rate. If the HECM interest rate adjusts monthly, then the cap is $35. (Note: Fairway does not currently charge servicing fees on HECM loans it originates.)

Generally speaking, HECMs are more expensive than traditional mortgage products. But they also offer a unique set of benefits that are specifically designed to meet the needs of older American homeowners.

So, a reverse mortgage might be right for you and worth the costs—or it might not be. Like any other purchase decision you make, it all depends on whether you feel the benefits you receive outweigh the costs.

For instance, let’s assume you are trying to decide between using a HELOC and HECM line of credit to leverage your housing wealth in retirement. Like a HECM, a HELOC lets the borrower use funds drawn from a home-secured line of credit for any purpose. But a HELOC and HECM work in different ways and have different implications.

While a HELOC may have lower overall costs, a HECM line of credit offers some distinct advantages that can be very appealing to older homeowners. Here’s a features comparison chart of the two products:

| Home Equity Line of Credit (HELOC) | HECM Line of Credit | |

| Do I own the home and remain on title? | Yes | Yes |

| As an adult, is there a minimum age that I need to be? | No | 62+ |

| Do the unused funds in the line of credit accrue interest? | No | No |

| Are there required monthly principal and/or interest mortgage payments? | Yes | No (1) |

| Does the unused portion of the line of credit grow over time to produce greater borrowing capacity? | No | Yes (grows at the same rate as loan balance) |

| Is it a non-recourse loan? (never owe more than the home is worth when it is sold) (2) | No | Yes |

| Are the draw periods limited? | Yes, typically there’s a 5- or 10-year draw period (timeframe depends on product) | No |

| Are there any prepayment penalties? | Depends on product | No |

| Which product is generally easier for 62+ homeowners to qualify for? | More difficult | Easier |

| Can the line of credit be frozen, reduced or canceled based on market conditions? | Yes | No |

Is a Reverse Mortgage Right for You or a Loved One?

You may find that the opportunity costs of not getting a HECM—e.g., not having access to a secure, growing line of credit (growth applies to unused funds); not being able to defer repayment of the loan balance until a later date; and not having a non-recourse loan—outweighs the upfront and ongoing costs associated with securing a HECM.

If you’re considering a reverse mortgage for yourself or someone you care about, Fairway Independent Mortgage Corporation is here to help. Please contact us today to get the facts on today’s reverse mortgage loans.

(1) Must pay the property charges, like taxes and insurance.

(2) There are some circumstances that will cause the loan to mature and the balance to become due and payable. Borrower is still responsible for paying property taxes and insurance and maintaining the home. Credit subject to age, property and some limited debt qualifications. Program rates, fees, terms and conditions are not available in all states and subject to change.