For financial planners, risk mitigation is essential. So even if a new product category presents significant potential for benefits, it will not be recommended to clients if there are too many unknowns. Those unknowns are what cause many financial planners to ignore the potential benefits of reverse mortgage loans, even though this product is not adversely affected by risks like market volatility and unexpected increases to the cost of living.

The following are the top three reasons why financial planners should learn more about reverse mortgage loans and bring them into their financial planning toolkits.

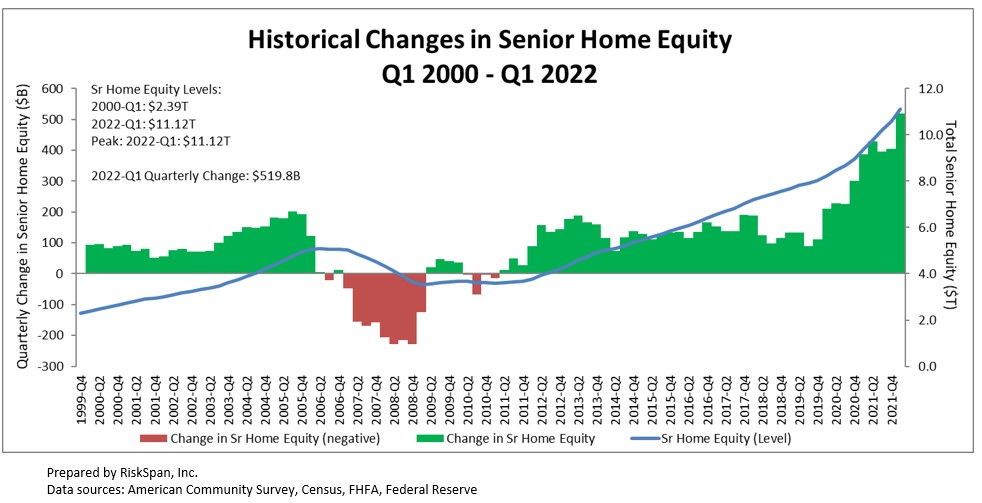

There Are More Than 11.12 Untapped Dollars That Could Be Directly Managed for Better Retirements.

Senior home equity has reached historic highs. As of 2022, homeowners 62 and older were holding over $11.12 trillion in home equity. This vast reserve of untouched capital should be intriguing for all financial professionals. But to bring it to the level of financial planning for the average client, how much better could their financial future be if they had hundreds of thousands of more dollars for you to manage?2

Many Retirees and People of Retirement Age Are Struggling with Debt.

Americans above the age of 60 carry $3.24 trillion in debt3, and about 40% of homeowners 62 and older still pay a monthly mortgage. Even under normal circumstances for a retiree, a monthly mortgage payment or any interest bearing debt can restrict cash flow to stressful levels. When mixed with inflation or financial losses, monetary resources can become strained. Considering that many couples spend an average of $300,000 dollars on healthcare in retirement, the seriousness of debt cannot be overstated.4

Client Home Equity Can Be in Your Hands to Manage—Mortgage Payments and Other Debt Can Be Erased.

It’s estimated that people over the age of 65 have more than 67% of their wealth in home equity,5 and those dollars could strengthen your assets under management. Reverse mortgage loans turn that equity into tax-free* loan proceeds in a variety of forms, including lump sum, monthly cash flow, and line of credit—or a combination thereof.

Even if the home is not fully paid off when the loan is taken, the homeowner is never obligated to make monthly mortgage payments again. They just need to pay taxes, insurance, and maintain the home. That money can be applied directly to other debts that accrue interest, used to manage sequence of returns, leveraged as capital for portfolio investments, or applied to a number of other financial solutions.*

Today’s Reverse Mortgage Loans Are Built with Robust Consumer Protections.

Many people, including financial professionals, still view reverse mortgages as “loans of last resort.” This is unfortunate as many of the product features that created this negative impression no longer exist.

In 2013, The Reverse Mortgage Stabilization Act added a suite of consumer protections. Then in 2014, the Federal Housing Administration (FHA) revamped the most common reverse mortgage loan known as Home Equity Conversion Loan (HECM), making it highly useful in financial planning.

Since 2014, HECMs have become an advantageous financial tool.

The following are some of the major protective features for consumers.

Get to Know Reverse Mortgage Loans

Considering the amount of untapped capital, financial pressures experienced by many retirees, and robust consumer protections, reverse mortgage loans are well worth the investment of time for financial planners to research.

Did you know that we have a proprietary tool called EquityTrax that maps home equity outlook throughout retirement?

Learn More About Our Tools for Financial Advisors!

Please fill out the form below and we will be in touch.

*This article does not constitute financial advice. Please consult a financial advisor regarding your specific situation.

* This article does not constitute tax and/or financial advice from Fairway.

1 – https://home.com/senior-home-equity-hits-9-2-trillion/

2 – https://reversemortgagedaily.com/2021/04/01/financial-planner-how-reverse-mortgage-pros-can-approach-people-like-me/

3 – https://www.newyorkfed.org/microeconomics/hhdc/background.html

4 – https://dailygoldsilvernews.com/senior-housing-wealth-hits-record-high-themreport-com-the-mreport/

5 – https://wallethacks.com/average-net-worth-by-age-americans/#medianagetype