Traditional home loans that enable borrowers to tap into their home equity are typically inflexible in how they provide funds to borrowers.

In contrast, reverse mortgage loans offer various payout choices, empowering borrowers to select the one that best meets their unique needs and objectives.

Understanding Reverse Mortgage Loans

The FHA-insured Home Equity Conversion Mortgage (HECM) stands out as the most popular type of reverse mortgage loan among borrowers. Tailored for homeowners 62 and over, HECMs enable individuals to tap into a portion of their home equity as cash.

Repayment of the loan balance is typically deferred until the last surviving borrower permanently vacates the property or passes away. While there are no mandatory principal and interest mortgage payments, it’s important to note that essential property charges, such as taxes and insurance, remain the borrower’s responsibility. Additionally, at least one borrower must continue to reside in the home as their primary residence.

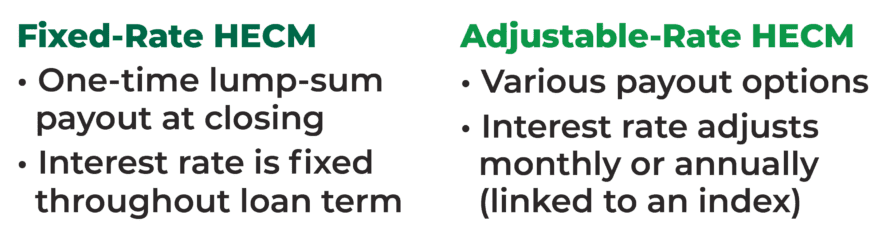

The most popular reverse mortgage in the U.S. is the Federal Housing Administration (FHA)-insured Home Equity Conversion Mortgage (HECM) loan. A HECM allows homeowners and homebuyers 62 and over to convert a portion of their home equity into a lump sum of cash, fixed monthly payouts, a line of credit or a combination of these options.

For simplicity, this article will refer only to the HECM reverse mortgage option. Fairway is ready to assist if you require specific information on any other type of reverse mortgage loan.

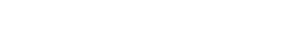

Fixed-Rate vs. Adjustable-Rate HECMs

HECMs present different payout guidelines based on whether borrowers opt for a fixed or adjustable interest rate.

Fixed-rate HECMs offer only a one-time lump-sum payout of loan proceeds at closing, with the interest rate remaining fixed throughout the loan term.

Conversely, adjustable-rate HECMs (or HECM ARMs) provide various payout options beyond the initial draw, including a line of credit and fixed monthly advances. The interest rate for a HECM ARM is linked to an index, with adjustments occurring monthly or annually.

Initial Disbursement Limits

A HECM limit calculation, known as the principal limit, determines how much a principal borrower can access, factoring in variables like property value and expected interest rate. HECM borrowers encounter limitations on initial withdrawals, whether at closing for fixed-rate HECMs or during the initial year for HECM ARMs, which offer future withdrawal options.

This initial disbursement limit is the greater of 60% of the principal limit or obligatory payoffs (such as clearing a mortgage lien) plus an additional 10% of the principal limit.

Here’s the bottom line: HECM ARM borrowers frequently gain access to a greater share of their home equity, given their ability to utilize any remaining principal limit (plus growth) beyond the first year. The growth feature embedded in the HECM line of credit is particularly noteworthy. Its unused portion expands over time, providing borrowers with augmented borrowing potential. For these advantages, the overwhelming majority of HECM borrowers favor the ARM over the fixed-rate option.

HECM ARM Payout Options

Can You Alter How You Receive Your HECM ARM Loan Proceeds?

Yes! You can transition to a different payout option for your HECM ARM. Simply reach out to your lender or servicer to initiate the change. Note: There may be a nominal servicing fee associated with this adjustment (typically no more than $20).

However, if you wish to switch between a HECM ARM and a fixed-rate HECM, or vice versa, you’ll need to pursue a loan refinance.

Let’s Start a Conversation!

Reach out to us today to explore how a HECM can help support your retirement goals.